Share:

For eligible Asante employees enrolled in the Asante Savings Health Plan, a health saving account is a great way to set aside pre-tax dollars to be used for eligible health care expenses.

Keep in mind that annual HSA maximum contribution amounts are set by the IRS. It is the employee’s responsibility to monitor your HSA and the contributions made to the account throughout the year. Any contributions made to the account, either by you or by Asante, will count toward the IRS maximum limit.

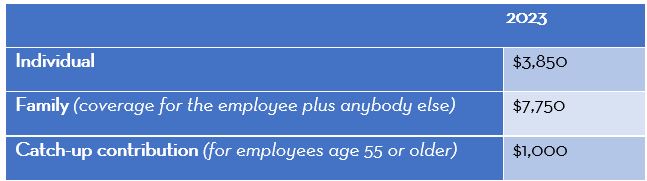

The IRS contribution limits for 2023 are:

You can view total contributions to your HSA on the HealthEquity website. Once logged in, go to My Account > HSA > Contribution History and update the year to 2023. The page will then display your 2023 HSA contribution totals, which you should compare to the IRS contribution limits above.

For more detail on how much you have contributed via payroll, as well as any Asante contributions, you can review your paycheck stubs on myHR (Pay > My Payroll Documents).

What you see on your paycheck stubs will not include any post-tax contributions made to the account. In addition, Asante does not have access to the balance of your HSA at any time.

If you have questions about the total contribution amount for a particular year, contact HealthEquity at (866) 960-8055.

If you have over-contributed to your HSA for 2023, go to Docs and Forms > General Forms on the HealthEquity website and complete the HSA mistaken contribution form to remove excess contributions.

HSA contributions can be changed or stopped at any time. This is done on myHR through My Life Events. From the main page of myHR, look for the widget titled Information about Life Events, and click on My Life Events. Add a new life event and select the change your HSA deduction option. Use the current date as the effective date. After opening the event, you can make the desired elections and submit them.

Any change to the amount takes effect the pay period that you submit the change; however, if you elect to waive your contributions entirely (which would keep the account open but stop your contributions), that change takes effect at the end of the month in which it’s submitted.

If you have additional questions, please contact HealthEquity at (866) 960-8055. You can also email Asante Benefits, call (541) 789-4551 or (800) 468-6913, or submit a case in the Ask HR section of myHR.

If you have a question, please contact the author or relevant department directly.